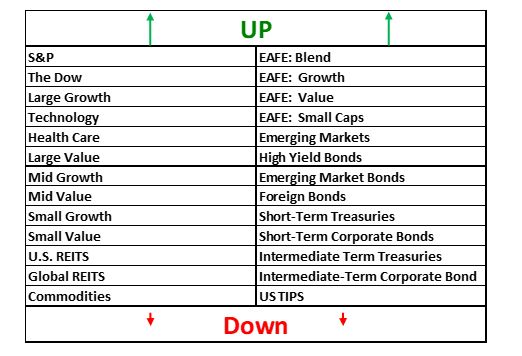

Last week…ALL asset classes were up again.

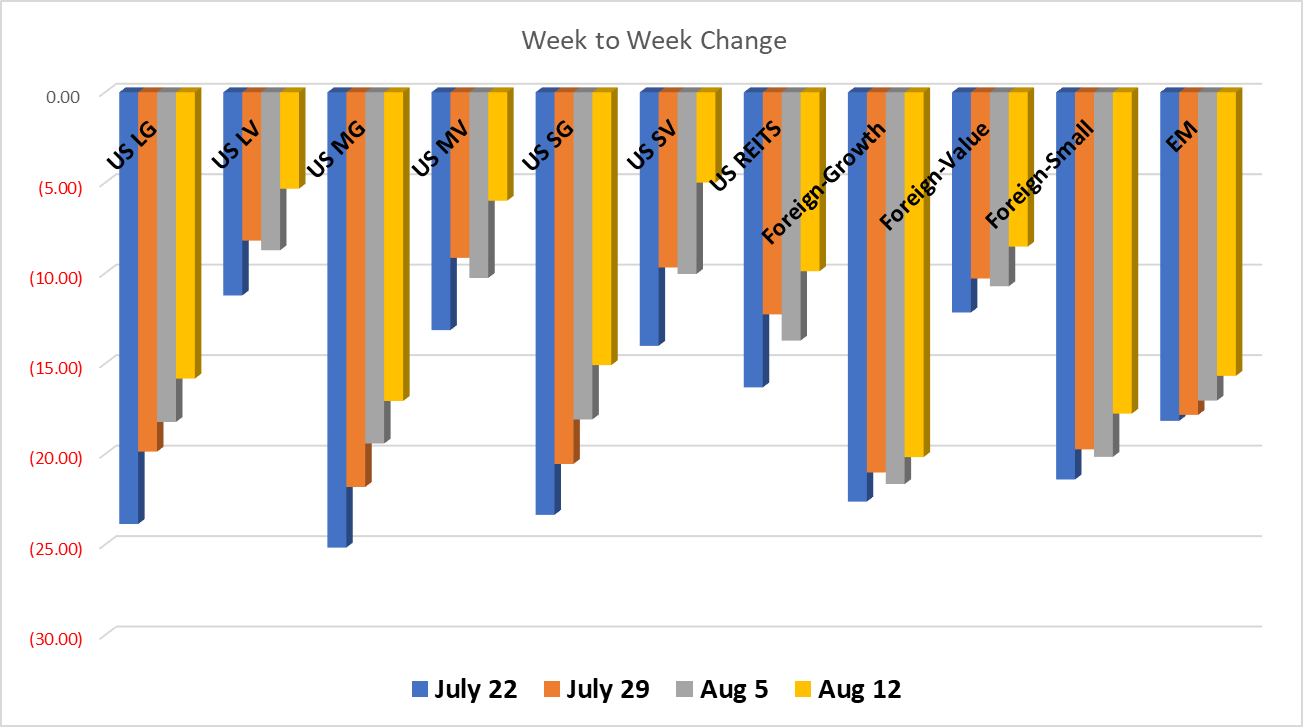

Equities across the board rallied, but even more so in the US. If you refer to the chart above, you note there has been a four-week upward trend across Large, Mid and Small Growth companies. Large, Mid and Small Value are also displaying an upward trend, only with slightly more volatility. Last week Value all outperformed growth gaining from 3.4% to over 5%.

US and Global REITS were both up with US gaining nearly 4% from last week. Commodities were our biggest gain from last week at close to 5.5%.

Foreign Equities behaved similar to US: All were up, Value outperformed growth and small caps outperformed large caps. Emerging Markets also continued its slow climb up, now with gains four weeks in a row.

Bonds were all up, though not nearly as much as their equity counterparts. But forward momentum is forward momentum.

Have a great weekend!

All performance reported in the graph and performance references are from the following index list: DJ Industrial Average TR USD, S&P 500 TR, DJ US TSM Large Cap Growth TR USD, NASDAQ 100, Technology NTTR TR USD, DJ US Health Care TR USD, DJ US TSM Large Cap Value TR USD, DJ US TSM Mid Cap Growth TR USD, DJ US TSM Mid Cap Value TR USD, DJ US TSM Small Cap Growth TR USD, DJ US TSM Small Cap Value TR USD, FTSE NAREIT All Equity REITs TR, DJ Gbl Ex US Select REIT TR USD, Bloomberg Commodity TR USD, MSCI EAFE NR USD, MSCI EAFE Growth NR USD, MSCI EAFE Value NR USD, MSCI EAFE Small Cap NR USD, MSCI EM NR USD, BBgBarc US Corporate High Yield TR USD, FTSE WGBI NonUSD USD, JPM EMBI Plus TR USD, BBgBarc US Govt 1-3 Yr TR USD, ICE BoafAML 1-3Y US Corp TR USD, BBgBarc Intermediate Treasury TR USD, BBgBarc Interm Corp TR, BBgBarc US Treasury US TIPS TR USD. This material has been prepared solely for informational purposes based upon data generally available to the public from sources believed to be reliable. All performance reporting is for indexes, not specific securities. Performance of specific securities will vary from indexes. Past performance is not an assurance of future results. Indexes cited are provided to illustrate market trends for certain asset classes. It is not possible to invest directly in an index. Indexes do not reflect individual investor costs of trading, expense ratios & advisory or other fees