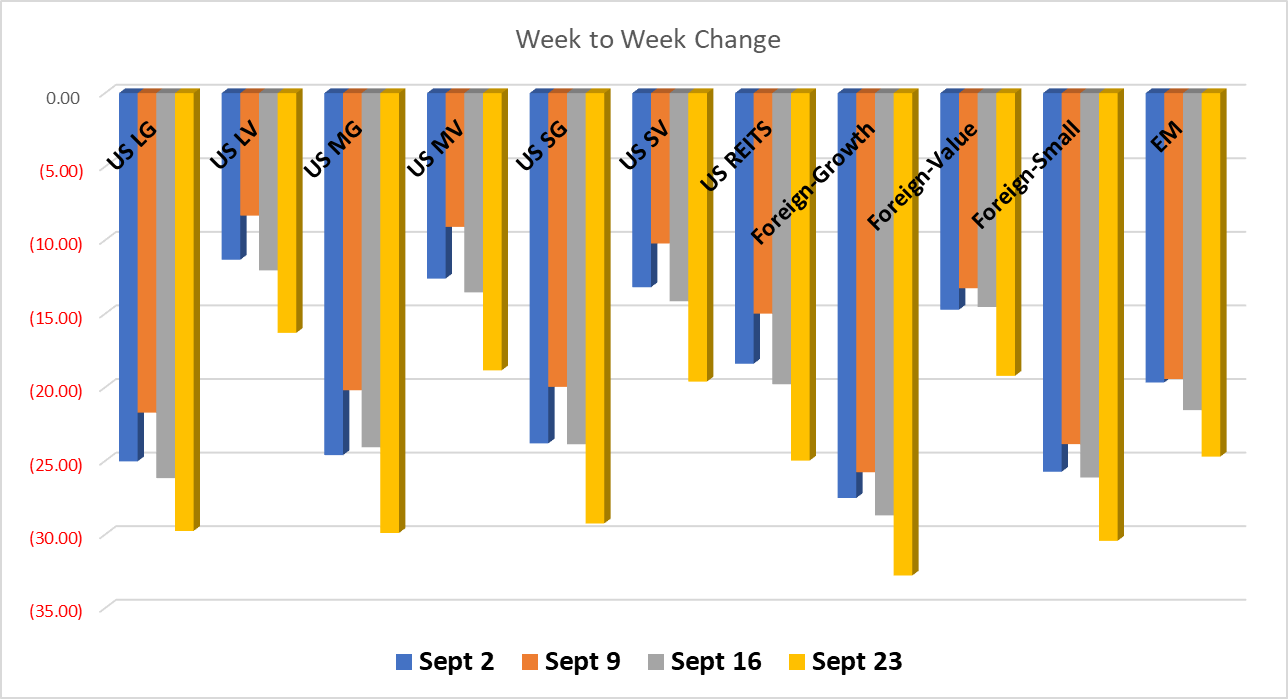

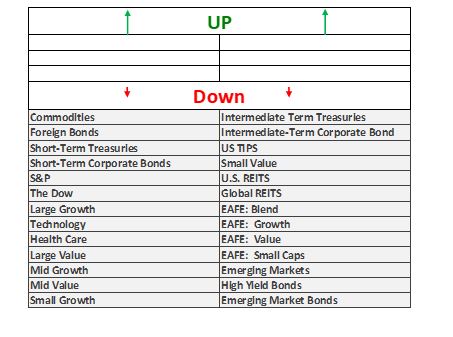

Unfortunately, more of the same downward trend!

I would love to be able to bring everyone good news! However, the markets did not seem to have the same intentions. The markets continue to trend downwards after the announcement of the rate hike from the Federal Reserve. The FED has announced their intentions moving into the end of 2022 are to hit a 4.40% overnight rate (this is the rate it costs banks to borrow money). Furthermore, they would like to keep this high interest rate environment at least through the end of 2023.

This isn’t all bad news though! Once these interest rate hikes trickle down into the economy the hope is to slow the rate of inflation. This will help bring pressure off all of our household budgets and everyday costs of living. When it comes to our investments it is important to remember, “The stock market always goes up and down on it’s way up.” It is not comfortable to see these drastic declines in the market, but it is important to remember these ups and downs are normal parts of economic growth! An analogy we love to use is an engine, it can only run so hot for so long before it needs time to cool off.

See you all next week! (Hopefully with some better news)

All performance reported in the graph and performance references are from the following index list: DJ Industrial Average TR USD, S&P 500 TR, DJ US TSM Large Cap Growth TR USD, NASDAQ 100, Technology NTTR TR USD, DJ US Health Care TR USD, DJ US TSM Large Cap Value TR USD, DJ US TSM Mid Cap Growth TR USD, DJ US TSM Mid Cap Value TR USD, DJ US TSM Small Cap Growth TR USD, DJ US TSM Small Cap Value TR USD, FTSE NAREIT All Equity REITs TR, DJ Gbl Ex US Select REIT TR USD, Bloomberg Commodity TR USD, MSCI EAFE NR USD, MSCI EAFE Growth NR USD, MSCI EAFE Value NR USD, MSCI EAFE Small Cap NR USD, MSCI EM NR USD, BBgBarc US Corporate High Yield TR USD, FTSE WGBI NonUSD USD, JPM EMBI Plus TR USD, BBgBarc US Govt 1-3 Yr TR USD, ICE BoafAML 1-3Y US Corp TR USD, BBgBarc Intermediate Treasury TR USD, BBgBarc Interm Corp TR, BBgBarc US Treasury US TIPS TR USD. This material has been prepared solely for informational purposes based upon data generally available to the public from sources believed to be reliable. All performance reporting is for indexes, not specific securities. Performance of specific securities will vary from indexes. Past performance is not an assurance of future results. Indexes cited are provided to illustrate market trends for certain asset classes. It is not possible to invest directly in an index. Indexes do not reflect individual investor costs of trading, expense ratios & advisory or other fees