More of the same!

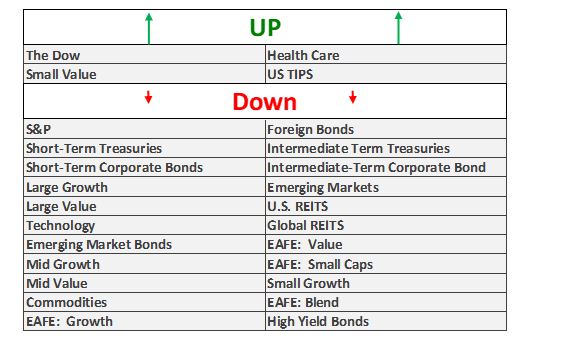

Last week the markets were not clear on where they were going to finish showing a few days of positive gains followed by more pullback. The market reacted negatively at the start of the week to poor inflation numbers that came out. But, with the start of a new quarterly earnings cycle, businesses reported good earnings, which helped prop the market up the latter half of the week.

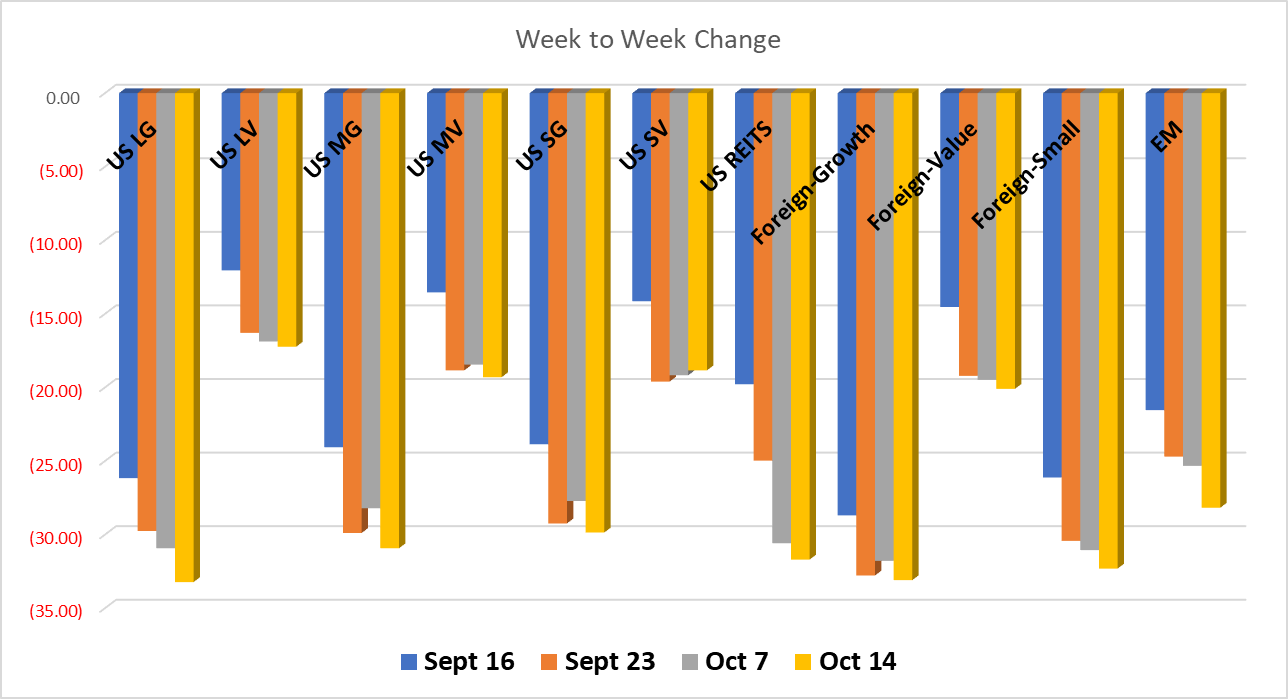

Looking at our charts we are able to see that growth companies both in the U.S. and foreign have taken the biggest hits and are all down around the same amount. While all value asset classes remain less impacted by the negative downturn.

Moving forward we can expect continued volatility as the markets look for any sign of good news amongst the bleak outlook. If key companies continue to report strong earnings, we may start to see a few more days in the green vs. the red. For now, we encourage everyone to hold on and make the most of a bumpy ride.

All performance reported in the graph and performance references are from the following index list: DJ Industrial Average TR USD, S&P 500 TR, DJ US TSM Large Cap Growth TR USD, NASDAQ 100, Technology NTTR TR USD, DJ US Health Care TR USD, DJ US TSM Large Cap Value TR USD, DJ US TSM Mid Cap Growth TR USD, DJ US TSM Mid Cap Value TR USD, DJ US TSM Small Cap Growth TR USD, DJ US TSM Small Cap Value TR USD, FTSE NAREIT All Equity REITs TR, DJ Gbl Ex US Select REIT TR USD, Bloomberg Commodity TR USD, MSCI EAFE NR USD, MSCI EAFE Growth NR USD, MSCI EAFE Value NR USD, MSCI EAFE Small Cap NR USD, MSCI EM NR USD, BBgBarc US Corporate High Yield TR USD, FTSE WGBI NonUSD USD, JPM EMBI Plus TR USD, BBgBarc US Govt 1-3 Yr TR USD, ICE BoafAML 1-3Y US Corp TR USD, BBgBarc Intermediate Treasury TR USD, BBgBarc Interm Corp TR, BBgBarc US Treasury US TIPS TR USD. This material has been prepared solely for informational purposes based upon data generally available to the public from sources believed to be reliable. All performance reporting is for indexes, not specific securities. Performance of specific securities will vary from indexes. Past performance is not an assurance of future results. Indexes cited are provided to illustrate market trends for certain asset classes. It is not possible to invest directly in an index. Indexes do not reflect individual investor costs of trading, expense ratios & advisory or other fees