The first week of good news we can report since early September. And a welcome report it is!!

The markets remain uncertain about the longer term for inflation, interest rates, and of course, the mid-terms right around the corner. Specific political views aside, we always encourage long term investors to separate their politics from portfolio strategy. And, historically markets tend to do better with divided government. This is attributed to less uncertainty about economic changes introduced by major policy shifts from Washington. It also reinforces the notion that markets historically don’t favor one party over another as much as we may think and changes create uncertainty that markets don’t like.

With the direction of interest rates and inflation already backed in, markets are turning to pretty decent numbers from the 3rd QTR earnings reports, nicely positive GDP, up 2.6% after contracting the first half of the year and the employment market still showing strength amid some slack.

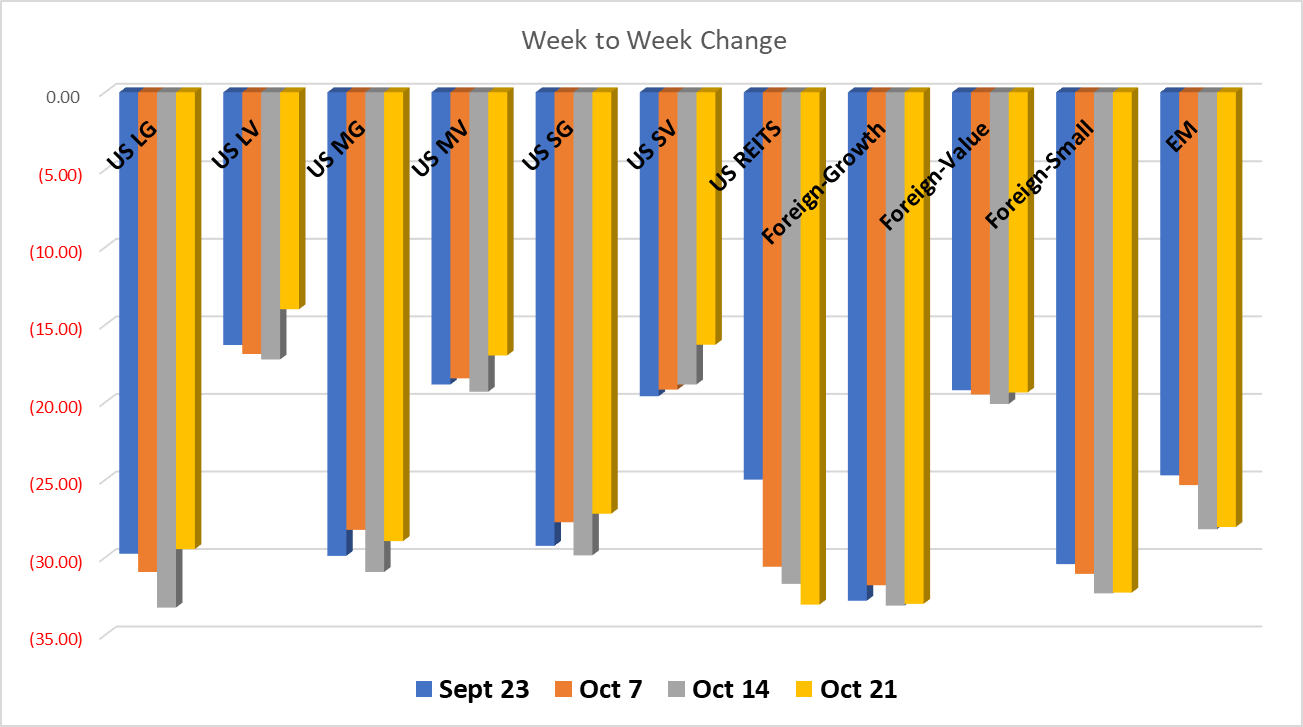

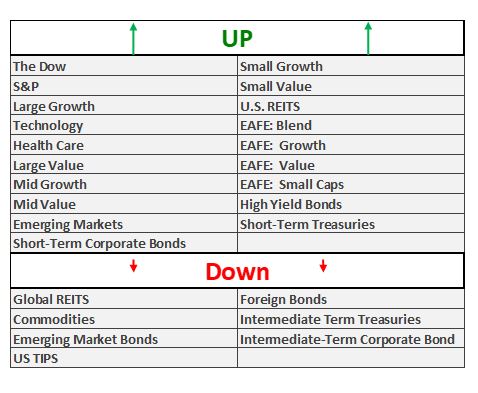

Benchmark returns for asset classes we track show some of the strongest gains seen during any week so far this year with all US Equities up from 2.0% to 4.0%. Large Caps generally were up more with both Growth and Value stocks running close to each other. Broad gains are always a good sign and that is seen here. That breadth showed up in all foreign stock benchmarks as well but, with less headway made across the pond. Still, all equities up in US, Foreign and Emerging Markets for the week is worth noting.

Not to get too far ahead of ourselves, we can’t help observing similar gains so far this week with the trend as we write, continuing to gain momentum. We’ll save numbers for next to avoid jinxing today’s close, but barring the unforeseen a two-week streak would be nice to report. Have a great fall weekend!

All performance reported in the graph and performance references are from the following index list: DJ Industrial Average TR USD, S&P 500 TR, DJ US TSM Large Cap Growth TR USD, NASDAQ 100, Technology NTTR TR USD, DJ US Health Care TR USD, DJ US TSM Large Cap Value TR USD, DJ US TSM Mid Cap Growth TR USD, DJ US TSM Mid Cap Value TR USD, DJ US TSM Small Cap Growth TR USD, DJ US TSM Small Cap Value TR USD, FTSE NAREIT All Equity REITs TR, DJ Gbl Ex US Select REIT TR USD, Bloomberg Commodity TR USD, MSCI EAFE NR USD, MSCI EAFE Growth NR USD, MSCI EAFE Value NR USD, MSCI EAFE Small Cap NR USD, MSCI EM NR USD, BBgBarc US Corporate High Yield TR USD, FTSE WGBI NonUSD USD, JPM EMBI Plus TR USD, BBgBarc US Govt 1-3 Yr TR USD, ICE BoafAML 1-3Y US Corp TR USD, BBgBarc Intermediate Treasury TR USD, BBgBarc Interm Corp TR, BBgBarc US Treasury US TIPS TR USD. This material has been prepared solely for informational purposes based upon data generally available to the public from sources believed to be reliable. All performance reporting is for indexes, not specific securities. Performance of specific securities will vary from indexes. Past performance is not an assurance of future results. Indexes cited are provided to illustrate market trends for certain asset classes. It is not possible to invest directly in an index. Indexes do not reflect individual investor costs of trading, expense ratios & advisory or other fees