Last Week…

… saw some interesting new patterns.

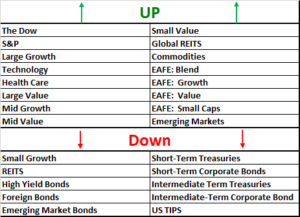

All US indexes saw modest growth except for Small Cap Growth

- Interestingly, Technology and Large Cap Growth were the lagers

- And Small Cap Value led the way at 1.36%!

- Small Cap Growth lost -0.28%

- US Equity REITS also lost -1.61%

- While Foreign REITS gained 0.62%

Foreign Stocks significantly outperformed US indexes as well

- Foreign Large Value was up 2.52%, ahead of Foreign Large Growth

- Foreign Large Growth advanced 1.94%

- Foreign Small Caps increased 2.0%

Bubbling bonds all took a breather while global stocks moved ahead

- Both Foreign and Emerging Market Bonds lost -0.63%

- Intermediate Term Corporate Bonds slipped -0.52%

- All other bonds were down less than -0.5%

This is the third week of what we call a ‘market rotation’ which is very positive looking ahead. In a crisis the market always prices in a ‘worst case scenario’ then moves on to assess the most likely economic conditions 6-18 months out. From there – (unless it appears the world as we know it cannot be imagined), and the projection is tolerable for economic growth, the market goes on to climb the ‘wall of worry’ it formerly constructed from the worst case already priced in. Rotation moves from the market leaders – whatever they may be, to the lagers whatever they may be, as it heals the deepest wounds..

Have a great weekend!

Indexes are listed in respective order to their reference above: DJ Industrial Average TR USD, S&P 500 TR, DJ US TSM Large Cap Growth TR USD, NASDAQ 100, Technology NTTR TR USD, DJ US Health Care TR USD, DJ US TSM Large Cap Value TR USD, DJ US TSM Mid Cap Growth TR USD, DJ US TSM Mid Cap Value TR USD, DJ US TSM Small Cap Growth TR USD, DJ US TSM Small Cap Value TR USD, FTSE NAREIT All Equity REITs TR, DJ Gbl Ex US Select REIT TR USD, Bloomberg Commodity TR USD, MSCI EAFE NR USD, MSCI EAFE Growth NR USD, MSCI EAFE Value NR USD, MSCI EAFE Small Cap NR USD, MSCI EM NR USD, BBgBarc US Corporate High Yield TR USD, FTSE WGBI NonUSD USD, JPM EMBI Plus TR USD, BBgBarc US Govt 1-3 Yr TR USD, ICE BoafAML 1-3Y US Corp TR USD, BBgBarc Intermediate Treasury TR USD, BBgBarc Interm Corp TR, BBgBarc US Treasury US TIPS TR USD. These materials have been prepared solely for informational purposes based upon data generally available to the public from sources believed to be reliable. All performance references are to benchmark indexes. Performance of specific funds will vary from respective benchmarks. Past performance is not an assurance of future results. Each index cited is provided to illustrate market trends for various asset classes. It is not possible to invest directly in an index. Neither do Indexes reflect individual investor costs, e.g. trading, expense ratios & potential advisory fees.