Last Week…

… Things evened out a bit

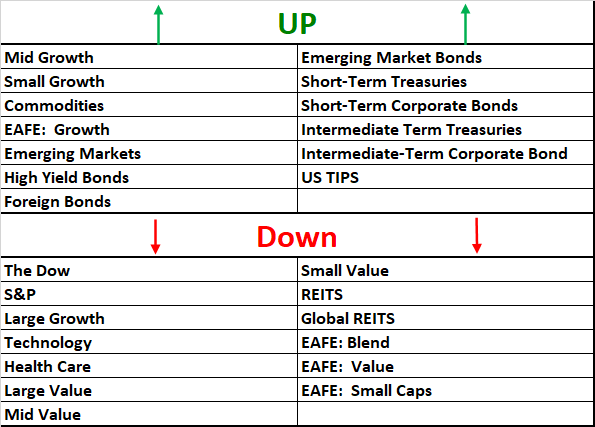

US stocks are still in rotation

- The Dow, S&P, Technology and Healthcare lost some momentum, but losses were under 2%

- Large Value went down just a little -0.63%

- Mid and Small Value fell a bit as well: -0.76% and 0.27%

- Mid and Small Cap Growth stood alone with gains of +1.27% & +1.96%

- REITS and Foreign REITS both lost traction -2.42% and -0.84%, respectively

Foreign stocks were all over

- Emerging Markets took the lead +0.62%

Bonds are back to barely bubbling –However, that has translated into momentum for the year. Bonds are running at a very nice clip of 3-10% YTD, nothing to sneeze at!

- All are up with the majority over 5% YTD

- TIPS have over 10% return YTD

- Short Term Treasuries are the lowest at 3% YTD

Have a great weekend!

Indexes are listed in respective order to their reference above: DJ Industrial Average TR USD, S&P 500 TR, DJ US TSM Large Cap Growth TR USD, NASDAQ 100, Technology NTTR TR USD, DJ US Health Care TR USD, DJ US TSM Large Cap Value TR USD, DJ US TSM Mid Cap Growth TR USD, DJ US TSM Mid Cap Value TR USD, DJ US TSM Small Cap Growth TR USD, DJ US TSM Small Cap Value TR USD, FTSE NAREIT All Equity REITs TR, DJ Gbl Ex US Select REIT TR USD, Bloomberg Commodity TR USD, MSCI EAFE NR USD, MSCI EAFE Growth NR USD, MSCI EAFE Value NR USD, MSCI EAFE Small Cap NR USD, MSCI EM NR USD, BBgBarc US Corporate High Yield TR USD, FTSE WGBI NonUSD USD, JPM EMBI Plus TR USD, BBgBarc US Govt 1-3 Yr TR USD, ICE BoafAML 1-3Y US Corp TR USD, BBgBarc Intermediate Treasury TR USD, BBgBarc Interm Corp TR, BBgBarc US Treasury US TIPS TR USD. These materials have been prepared solely for informational purposes based upon data generally available to the public from sources believed to be reliable. All performance references are to benchmark indexes. Performance of specific funds will vary from respective benchmarks. Past performance is not an assurance of future results. Each index cited is provided to illustrate market trends for various asset classes. It is not possible to invest directly in an index. Neither do Indexes reflect individual investor costs, e.g. trading, expense ratios & potential advisory fee.