Last Week…

… definitely ended on down note

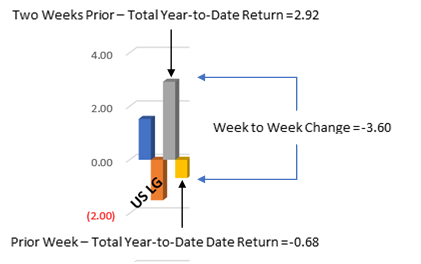

*Please note. You may have noticed we have started using a new chart along with this report. For the more nerdy types that would like a visual of our chart, here’s a small example of how to read what you are looking at.

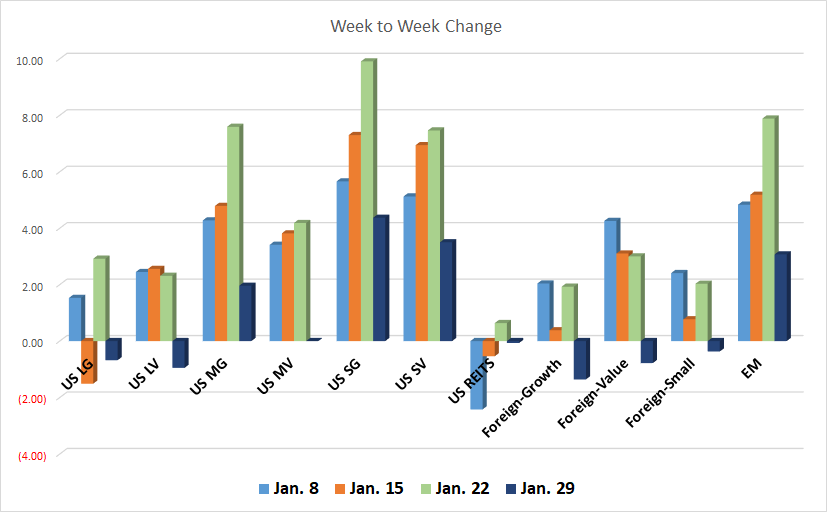

- US LG – US Large Growth

- US LV – US Large Value

- US MG – US Mid Growth

- US MV – US Mid Value

- US SG – US Small Growth

- US SV – US Small Value

- US REITS – US Real Estate Investment Trusts

- Foreign-Growth

- Foreign-Value

- Foreign-Small

- EM – Emerging Markets

- (specific benchmarks listed in disclaimer)

Despite this, Economic indicators are still looking good on the whole – worrisome signs remain, yet the market is weighing other REALLY strong areas.

- US Healthcare slipped the least -2.14%

- US Mid Growth fell furthest -5.63%

- US REITS gave up -0.71% – and now just barely in the negative.

- Global REITS moved ahead +0.87% but, remain slightly in the negative as well YTD

- Commodities rose another +1.26% and are now positive for the 1,2 and 5 year average trailing return!

Foreign markets were down about the same as US

- Emerging Markets fell -4.82% but are still up 3.07% YTD

Bonds remain too boring to bother with this week.

There was a lot of market volatility last week. We believe most of this reflects sensitivity to the drama with Gamestop and the Robinhood stock spectacle. When unexpected incidents like this occur it can unnerve investors about the direction the market is moving. The dramatic attention on a handful of stocks apparently distracted investors from what the better-than-forecast 4th Quarter 2020 corporate earnings report. The decline for S&P 500 earnings for the last quarter of 2020 from the previous year came in at less than 5%. The expected decline was for double that decline. It also looks like first quarter corporate earnings for this year will beat forecasts as well. Analysts believe earnings recovery is very important to market valuation. The “short story” here is the GameStop news served as distraction to investors from otherwise very positive market fundamentals.

Have a great weekend!