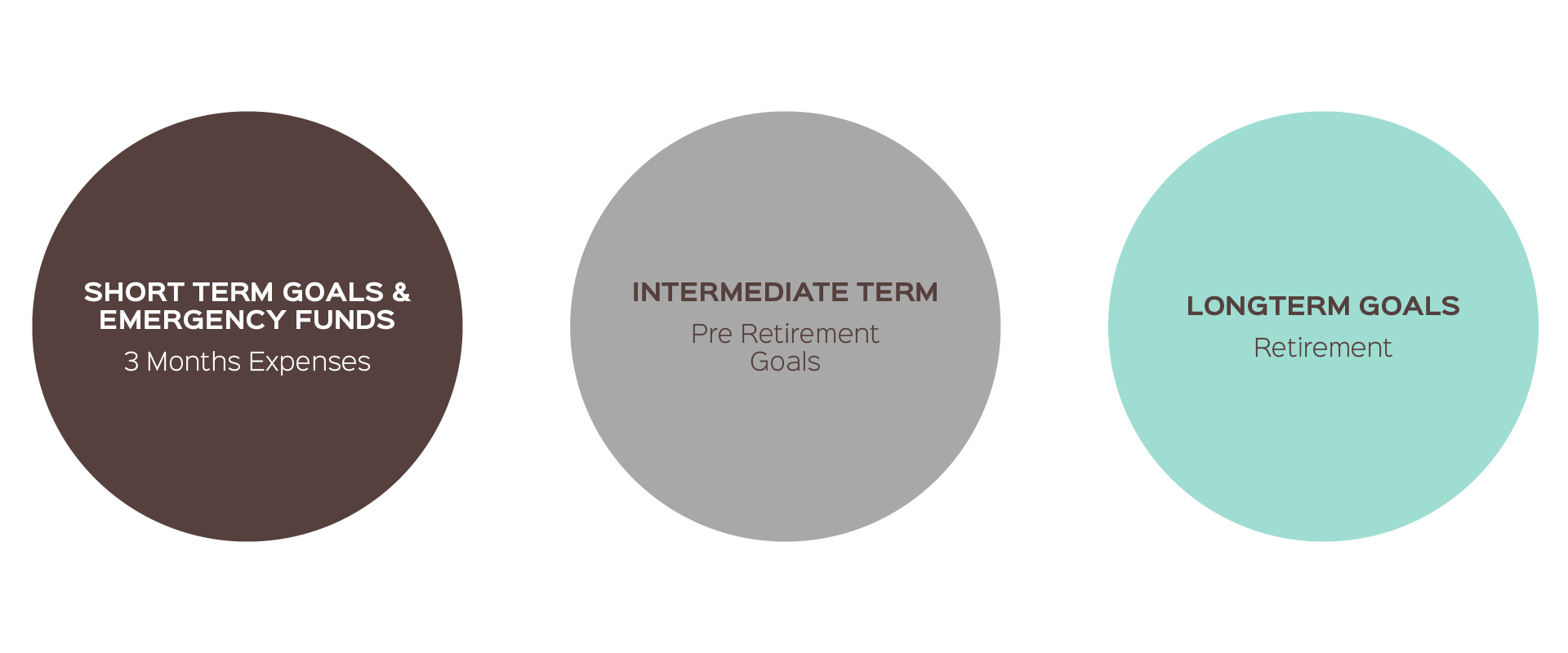

Three Circle Rules

Keep these three circles moving and growing and you will find yourself feeling more freedom to enjoy ‘worthwhile living’ and a super great retirement!

And stay encouraged – We are your greatest cheerleaders!

Learn More

Rule 1 – Into the first circle, save 10% of every paycheck and other sources of income until you have three months of expenses. (see circles)

Rule 2 – When the 1st circle is funded shift savings into the 3rd circle retirement plans. Max out retirement savings before moving to rule 3.

Rule 3 – Begin savings into 2nd circle. These funds should be invested in after tax accounts recommended with the help of a fee-only CFP®.

Rule 4 – For unexpected, surprise money allocate as follows: 10% for fun and 90% to your three circles, as already described.