Last Week…and actually, up through this Monday’s close – (numbers from last Friday’s close were not captured)

… the market went on a four-day dash!

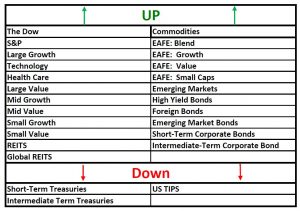

US Equities were ALL up. Nearly 4% to more than 10.0 %!

- Large Cap Value, the lagger moving up +3.95%

- Small Cap Growth, moving up 8.15% has now reached the cusp of double digits YTD!

- In this latest surge, Technology was not to be found in the pack but moved ahead another 10.16% reaching 38.74% YTD.

- Small Value participated in the run with a 4.32% gain as well.

REITS and Commodities moved up

- US REITS came up 1.54%

- Foreign REITS rose 1.18%

- Commodities rose 3.7%

Foreign Equities also did well though not as outstandingly US Indexes

- All classes rose more than 3.0%

- Emerging Markets surged 5.1% into the black YTD.

Bonds remained steady

- High Yield and Emerging Markets advanced 1.21% and 1.1% respectively

Even with numbers amplified a bit by the additional day to our normal weekly tracking, it’s noteworthy that this very “V-shaped” recovery continues to broaden across economic sectors and more importantly, the asset classes and sub-classes into which we invest. At the same time, we have to go back to the bear market of 2000-2002 to see such a deep divergence between Growth and Value stocks and between Large and Small US stocks. The market’s shock from the pandemic shut-down devastated smaller, less pricey stocks which remain 60% behind their larger, more expensive cousins in the US. Yet, the turn for Small Value has been under way for several months now even as larger growth stocks and especially technology have staged the strongest V-shaped turnaround in modern history!

Have a great weekend!