Last Week…

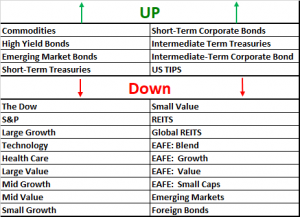

… The only equity asset class that wasn’t down was Commodities – GASP!

And bonds benevolently bubbled blithely up, with exception of Foreign Bonds.

And that’s all we’ll say about the ups and downs. Of particular interest to us this week was the long-term, 10-15 year trailing return. Most investors understand that LONG-TERM, if you hang on in the good and bad times, an asset can expect to earn on AVERAGE 8-10% over a long-term period. This week we noted the 10-year trailing for U.S. equities were all withing that 8-10% range, except U.S. Small Value. In the 15-year trailing, Large Growth, Tech, Health Care, Mid Growth and Small Growth were all well above 10%.

It’s almost like nothing happened earlier this year for growth companies. And it further illustrates just where the bomb landed earlier this year – value companies with Small Value being dead center of impact. Large, Mid and Small Value companies remain down YTD, but Small Companies are down the most – over 24% YTD. Their trailing return is 6.5% in 10 years and 5.95% at 15. We took a look back at March numbers, and it was dismal. You think 24% YTD return is not good, but look how far it has bounced back. In March Small value was down over 46%.

Though COVID has had a major impact on small businesses as many of us are well aware, American ingenuity – the economic engine of the globe, remains strong and thriving. A devasting blow has been taken. But this will not be the end of small businesses per se′, for diversified investors in their accounts. In fact, exceptionally savvy entrepreneurs have adapted, identified new opportunities, been able to rebrand, develop new products and move forward amidst this otherwise tragic crisis.

Have a great weekend!