Last week…

…everything was down except a couple bonds.

These numbers don’t really surprise us. Historically, with the end of summer/beginning of fall the market tends to slow down a bit. August and September are known to be the lowest performing months.

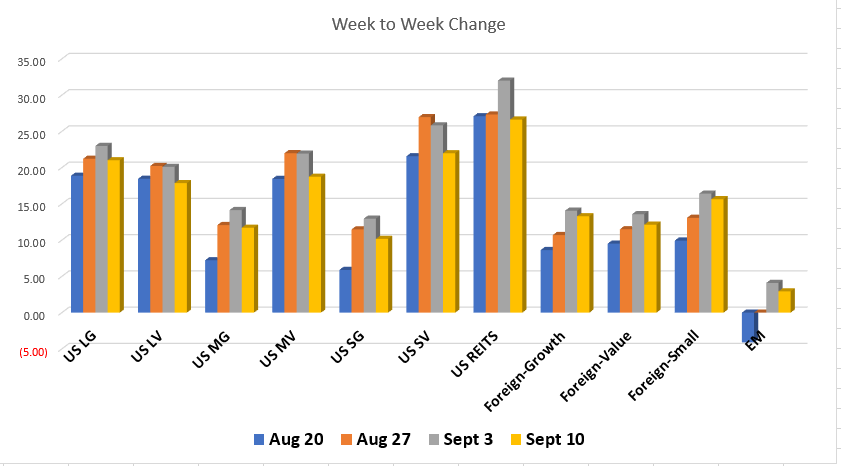

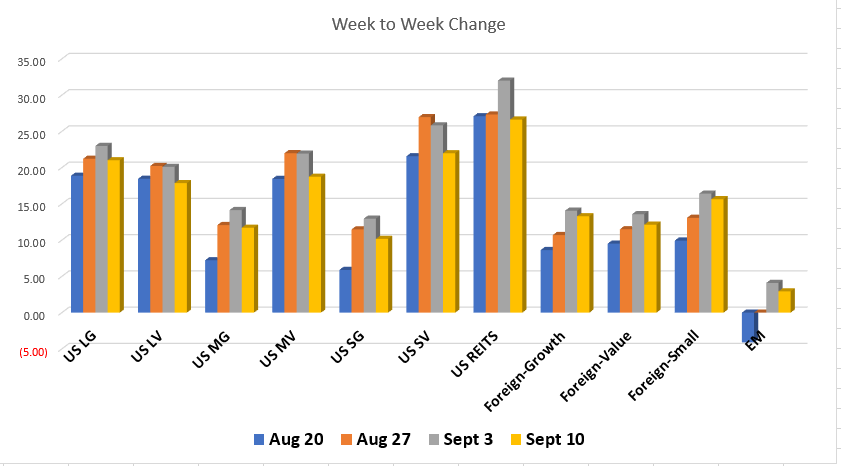

US Equities lost 2-3% across the board. Large companies lost less than mid companies which lost less than small companies. As we mentioned in previous weeks, it is becoming more apparent that small, mid and large companies are evening out with their YTD returns. So, are small companies slowing down or large companies growing more? It’s a little bit of both.

Last week we praised US REITS for their big gain, crossing the 30% YTD return threshold. Now they are the biggest loser, slipping over 5%. REITS also gave up their lead to Tech by .2%.

Foreign Equities were down as well but not nearly as much as the US.

Now for the only positive gains from the previous week: US High Yield and TIPS. High Yield was up 0.12% and TIPS up 0.5%. These two bonds are also our YTD leader with both close to 5% returns.

We often try to speculate what might be driving the market’s performance. There’s no really bad news out there right now, right? Just no good news. But is no good news bad? You can run yourself in circles speculating. Overall, we are here as long-term investors and know that if you stay committed to your investment strategy, history proves what can be done!

Have a great weekend!