Last week…

…the market was spooked!

By what? Possibly the announcement of another COVID variant.

We only had two asset classes across both equities AND fixed income that showed a gain from the previous week. Those winners were Short Term Treasuries and Intermediate Term Treasuries.

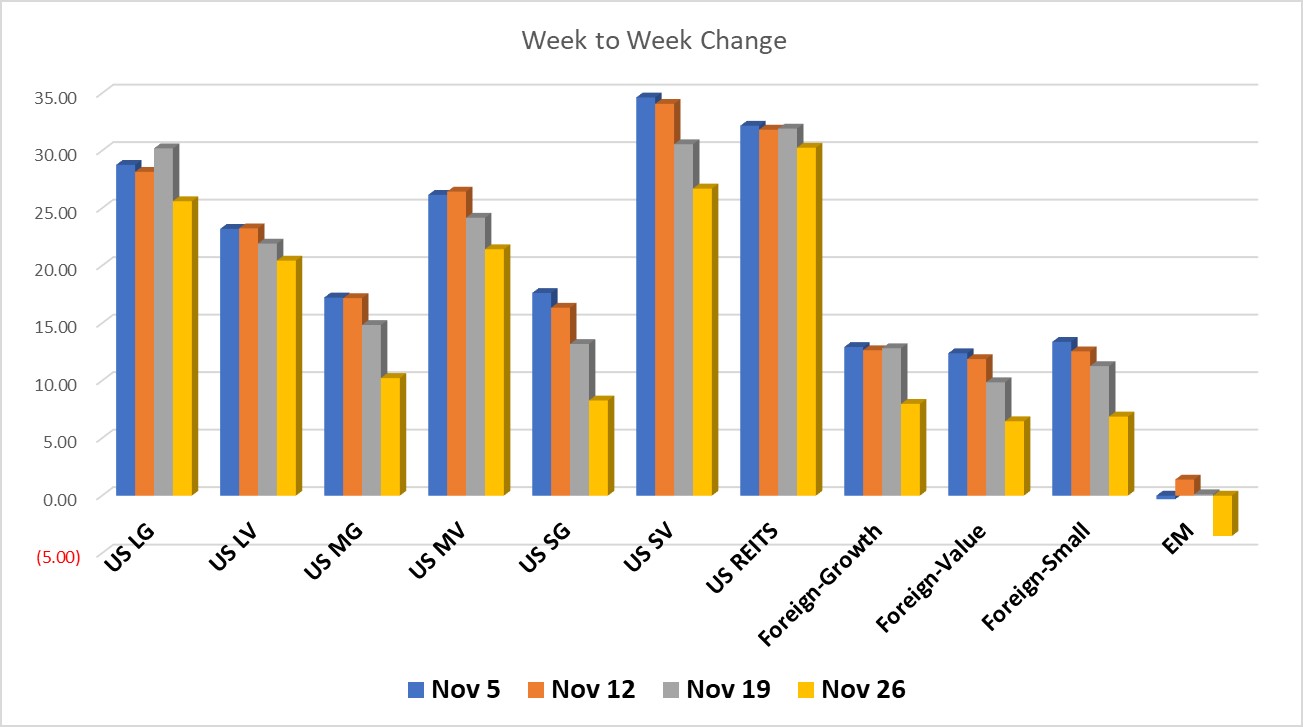

US Equities were down from 1-5% with the largest sell off in growth companies. Technology took the biggest hit down over 5%, but that’s because it had the most to lose. Down 5% in one week sounds like a lot, but the Tech still holds a YTD return of 33.62%.

REITS were down but not as much as the rest of the US Equities markets. Commodities slipped a little as well. Foreign Equities were down over 3%. And Emerging Markets are back in the red after two weeks positive.

Bonds, except for the aforementioned were down just a little bit.

This seems like a good opportunity to iterate that while we watch the week-to-week ups and downs and mention “gains” and “losses” we teach that in order to realize those “gains” and “losses” you must sell! So, don’t get spooked like everyone else!

Have a great weekend!

All performance reported in the graph and performance references are from the following index list: DJ Industrial Average TR USD, S&P 500 TR, DJ US TSM Large Cap Growth TR USD, NASDAQ 100, Technology NTTR TR USD, DJ US Health Care TR USD, DJ US TSM Large Cap Value TR USD, DJ US TSM Mid Cap Growth TR USD, DJ US TSM Mid Cap Value TR USD, DJ US TSM Small Cap Growth TR USD, DJ US TSM Small Cap Value TR USD, FTSE NAREIT All Equity REITs TR, DJ Gbl Ex US Select REIT TR USD, Bloomberg Commodity TR USD, MSCI EAFE NR USD, MSCI EAFE Growth NR USD, MSCI EAFE Value NR USD, MSCI EAFE Small Cap NR USD, MSCI EM NR USD, BBgBarc US Corporate High Yield TR USD, FTSE WGBI NonUSD USD, JPM EMBI Plus TR USD, BBgBarc US Govt 1-3 Yr TR USD, ICE BoafAML 1-3Y US Corp TR USD, BBgBarc Intermediate Treasury TR USD, BBgBarc Interm Corp TR, BBgBarc US Treasury US TIPS TR USD. This material has been prepared solely for informational purposes based upon data generally available to the public from sources believed to be reliable. All performance reporting is for indexes, not specific securities. Performance of specific securities will vary from indexes. Past performance is not an assurance of future results. Indexes cited are provided to illustrate market trends for certain asset classes. It is not possible to invest directly in an index. Indexes do not reflect individual investor costs of trading, expense ratios & advisory or other fees