How To Balance Saving for Tomorrow and Living For Today

Here are 5 tips to help you enjoy your money today while also setting yourself up for the future!

Prioritize Living Wealthy Today

No, that doesn’t mean you need to go buy a private jet or a yacht!

Ask yourself, what does it mean for you to live a fulfilling life? Does it mean living near the city so you can enjoy a night out with friends on the weekend? Maybe you desire a flexible work schedule so you can spend time with your family.

No matter your version of a “wealthy” lifestyle, it’s critical to clarify the things that bring you joy and happiness. If you don’t understand what makes you happy, how are you going to craft a strategy that allows you to live your ideal life?

Once you understand the things that are most important to you, you can start the process of aligning your habits and resources with those priorities.

Know Your Goals (and What They Cost)

Saving money “just because” will certainly put you on the fast track to an unfulfilling and unsustainable future. We all need at least some degree of purpose and direction to embrace delayed gratification. Ask yourself the following questions.

- What are your short, medium, and long-term goals? Some examples might be buying a new house, going on a dream vacation, or funding a college education for your children.

- How much do these goals cost?

- What is the time horizon for each goal?

- How do you plan on saving and investing your money as part of your strategy?

Pro Tip: Once you’re clear on these items, do your absolute best to start now! You are inevitably going to feel overwhelmed. With that said, you can’t climb a mountain by staring at the top. Start with small wins and build momentum. These little actions and improvements add up over time. An extra $1,000 a month saved for a decade and you could quickly amass over $200,000!

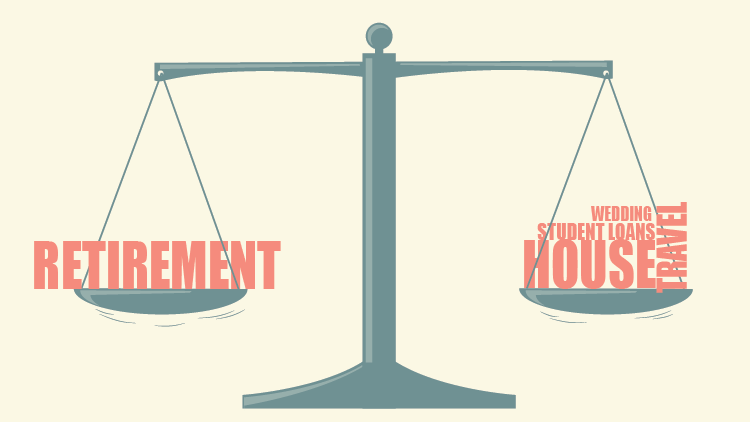

Embrace The Art of Prioritization

You may have answered the questions above and thought to yourself, “I have a lot of goals!”. This is where prioritization becomes extremely important.

If you really had to choose, which of your goals is most important? 2nd? 3rd?

You want to make sure you have a healthy blend of present and future when working through this exercise. Most can agree that balance rather than extremes—spend it all or save it all—will help create your ideal life.

Don’t think about what your priorities “should” be. Be honest with yourself. It’s ok if these look different than what people expect of you.

Ultimately, it’s helpful to save first and spend what’s left. Even if the savings is for a “spending” goal (like a vacation), prioritizing your savings over variable expenses will help you stay on track, and keep you moving closer to your ideal lifestyle.

Balance Isn’t 50/50

Maintaining a healthy balance of spending in the present and saving for the future doesn’t mean they will always have equal weight. At certain points in your life, you may be focusing heavily on one area.

Right now, in your peak earning years, your top priority might be saving for retirement. That could result in more resources funneled in that direction and less in others like updating a hall bathroom or picking up the tab for your grown children.

This is different for everyone. If you find yourself moving from one goal to another over time, that’s ok! The important thing is to keep moving forward.

When it comes to saving, time is extremely valuable. The earlier you start, the less critical every minute decision becomes. For example, if you start saving for retirement at 25, you become less reliant on market returns and leave room for periods of less saving.

But starting in your 40s puts a lot of pressure on you to save immediately and brings in other variables that you can’t control like market movements and unexpected life events.

Adjust As You Go

The world is dynamic, make sure your plan is, too. The plan you craft today may be completely different 5 years from now (and probably will be). You will grow and evolve and your plan should adjust right along with it. Don’t fight the changes that arise. Continue to make intelligent and thoughtful decisions to direct your energy towards your ever-changing goals/priorities.

Make sure you intentionally leave room for changes, mistakes, and updates. Do your best not to make decisions that limit your ability to make changes down the road (i.e. taking on too much debt).

The post How To Balance Saving for Tomorrow and Living For Today appeared first on Bienvenue Wealth LLC.